What is Prime Minister Employment Scheme?

This scheme is the

result of the merger of earlier two earlier schemes, Prime Minister`s Rojgar

Yojna (PMRY) and Rural Employment Generation Program (REGP).

Objective

- Generate

the employment opportunity in rural as well as in urban areas. This

purpose has to meet through the establishment of new micro-enterprise

/self-employed ventures/projects in rural as well as in the urban areas.

- To

bring together scattered artisans/rural and urban unemployed youth and to

give them the employment opportunity at their place

- To

provide continuous and sustainable employment to the

traditional/prospective artisans and rural and urban unemployed youth so

that migration can be stopped.

- To

help artisans in increasing the wage-earning capacity so that they can

contribute to the growth rate of urban and rural employment.

When was PMEGP started?

PMEGP started in

2008.

Who is monitoring the scheme?

PMEGP is the central

Government scheme. Ministry of Micro, small and medium enterprise is monitoring

the scheme

Implementing /Nodal Agency

At the

national level, the Nodal/Implementing Agency of this scheme is Khadi and

Village Industries Commission (KVIC) Mumbai. At the state level, State KVIC

directorates, State Khadi and Industries boards, and State khadi and village

industries Boards (KVIBs) will implement at the state level and District

Industries Centers (DICs) will implement at the rural level. Banks have been

assigned to implement the scheme. KVIC routs government subsidy directly into

the bank account of beneficiary/Entrepreneur through designated banks.

For the

identification of the beneficiaries, for getting the area- specific viable

projects, providing training, in the internship, handholding and mentoring of

the beneficiaries Implementing agency like KVIC/ KBIBs/DICs align with reputed

institutions like self- help groups (SHGs)/National small Industries

Corporation (NSIC)/Udami Mitra impaneled under Rajiv Gandhi Udami Mitra yojna

(RGUMY)/RSETIs/RUDSETIs/Panchayati Raj Institution and other relevant bodies.

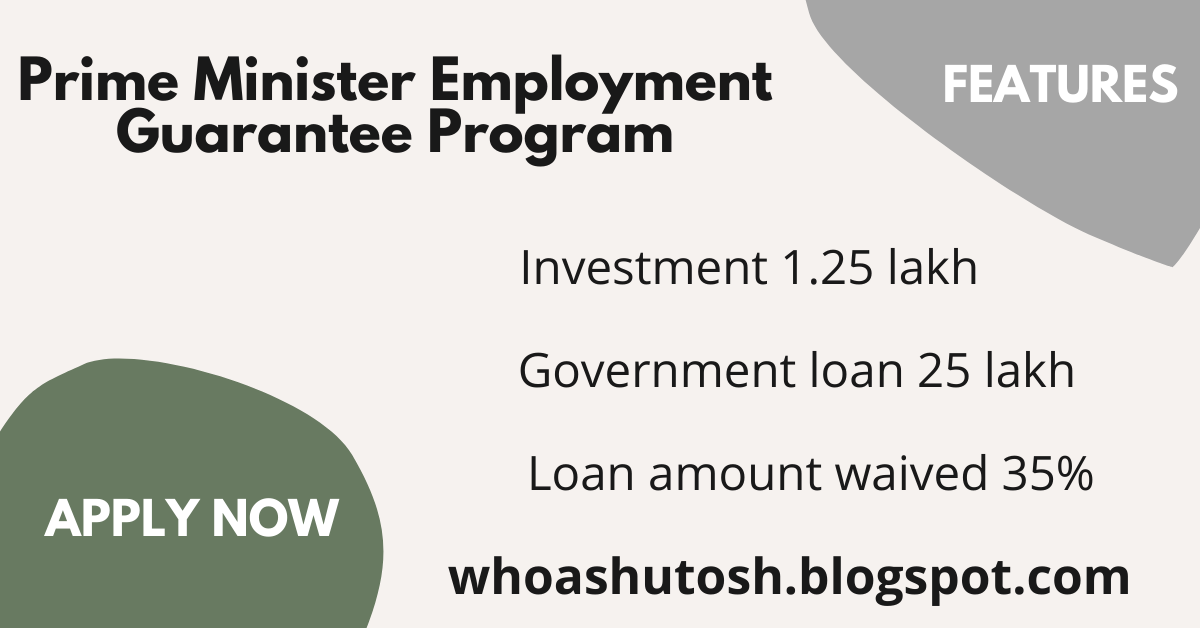

What is PMEGP loan limit?

- The

maximum cost of the project will be 25 lakh in the manufacturing sector

and 10 lakh under the business/service sector

- Out

of the total cost the applicant will have to bear 5% of the project cost

in case of in the special category ( including

SC/ST/OBC/Minority/Ex-servicemen/Physically handicapped/NER/Border areas

etc ) and 10% in case of the general category.

- The

Balance amount of the total project cost will be provided by the bank as

project cost.

How much margin money (Government Subsidy) is available?

The Subsidy will be

available as below-

|

Category

|

Urban

|

Rural

|

|

General

|

15%

|

25%

|

|

SC/ST/Minority/OBC/Women/ Ex.Service men/Physically handicapped/NER/Hill

and boarder areas etc

|

25%

|

35%

|

Who can avail of the scheme?

Individual/Group of

individual entrepreneurs, Institutions, Cooperative societies, self-help

groups, or trusts can avail this scheme.

Which are the disbursing agencies?

27 Public sector

banks, Regional Rural Banks (RRB), Co-operative banks(approved by state-level

task force committee), Private scheduled commercial banks approved by

respective task force committee, Small Industries Development Bank of India can

disburse the loan.

How can I create a project in a PMEGP loan?

Please follow the

following step:

- Choose

an idea of Interest to start a business in the manufacturing or service

sector

- Identify

suitable location/building/Plant( for good location extra marks are there)

you may refer to in marks chart in this article.

- Make

a project/business report ( Model business detail has been provided in

this article. You may refer to that)

Which business comes under PMEGP?

The Whole list of

PMEGP approved model business lists is available on the KVIConline website. You

may find the complete list of businesses here.

What are the potential projects?

You may find the

potential project here

Negative list of businesses that will not be funded under PMEGP

The following list

will not be allowed under PMEGP

- Any

Industry/Business connected with Meat

- Production/Sale

of intoxicant item like Beedi/Gutka/Pan/Cigar/Cigarette

- Any

Sales outlet serving Liquor

- Manufacturing

of Polythene carry bag of fewer than 20 microns

What is the minimum qualification for a PMEGP loan?

Applicant should

have passed the 8th class examination.

What should be the age limit of the beneficiary?

Any adult above the

age of 18 years is eligible for funding under the PMEGP.

Eligibility criteria for new units

- Applicant

should have more than 18 years of age

- There

is no income ceiling for availing of the benefit under PMEGP

- Applicant

should have at least 8th class pass for applying the project costing 10

lakh in the manufacturing sector and 5 lakh in business/service sector

- Subsidy

under PMEGP is available for new projects.

- Self-help

groups including BPL cardholders can also apply under this scheme provided

they have not availed subsidy in any other schemes.

- Society

registered under society registration act 1860/Charitable trust can also

avail the scheme.

- Any

existing unit under PMRY or any other scheme will not be eligible for the

loan.

- A

Project without capital expenditure will not be qualified for this scheme.

- Any

project valued less than 5 lakh which doesn’t require working capital

needs to be cleared from the regional office or the controller of the

bank`s branch. Any such claim should be submitted with a certified copy of

approval from the regional office or the controller of the bank`s branch.

- All

new viable micro-enterprise, including village industries projects except activities

prohibited by local Government/Authorities keeping in view environment or

socio-economic factors and activities keeping in view environment or

social-economic factors and activities indicated in the negative list of

the guidelines, can avail the PMEGP scheme.

- Any

institution /Cooperative Societies/Trusts specifically registered as in

special category like SC/ST/OBC/Minority/women/physically

handicapped/ex-serviceman. They have done necessary mention in their

by-laws then these societies will be eligible for subsidy under a special

category else they will be eligible for the subsidy in the general

category.

- Only

one member from the family (self or spouse) will be eligible under the

PMEGP scheme.

What is the main criterion of the project?

It should fulfill

the following condition:

- It

should full fill the terms and conditions of the rural area project (in

case the project is of the rural area)

- Per

capita investment

- Own

investment of the beneficiary

- The

Project should not be from the negative list

- The

Proposed unit should be the new one

What all will be considered in the project cost?

Project cost will

include capital expenditure loan, applicant`s share of one cycle of working

capital, and 10% of the project cost in case of general category or 5% in the

case is of from the weaker section.

How the Loan amount/Cash credit limit is utilized?

Working capital of

beneficiaries should touch 100% limit of cash credit within three years of the

lock-in period at least once and it should be 75% utilization of the sanctioned

limit on average.

Documents required

- Cast

certificate (if any)

- Special

category certificate, Where ever it is required

- Rural

area certificate

- Project

report

- Education/EDP/Skill

development training certificate

- In

case of institution self-attested copies of registration certificate,

authorization letter/copy of bylaws authorizing the secretary to apply,

certificate to special category (if any) will be required.

Is collateral Security a must?

No, collateral

security is not needed from the beneficiary. As per the RBI guidelines, Credit

guarantee fund trust for micro and small enterprise (CGTSME) will give the

collateral for the loan more than 5 lakh and up to 25 lakh

How much own contribution has to be deposited?

10% for general

category and 5 % for special category (including SC/ST/OBC/Minority/

Ex-servicemen/Physically handicapped/NER/Border areas etc) needs to be

contributed towards own share of contribution.

Where the applicant has to submit the application?

Applicants can

submit applications/project online on KVIC website

What is DIC in PMEGP?

DIC(District

Industries center ) has to play a very major role in PMEGP.DIC is an

implementing agency along with KVIC(Khadi and Village Industries Commission and

KVIB(Khadi and Village Industries Board)

Can an unemployed person get a loan?

Yes under this

scheme loan is collateral-free. So unemployed can also get a loan.

How do I adjust the PMEGP subsidy?

PMEGP subsidy can be

adjusted at the end of 3 years.

Loan for upgrading the existing PMEGP/MUDRA units

- The

maximum cost of the project will be 1 crore in the manufacturing sector

and 25 lakh under the business/service sector

- In

this category, the maximum subsidy will be 15 lakh (20 lakh will be for

NER and Hill states)

- The

balance amount of the total project will be funded by the bank as a term

loan.

Other activities covered under this scheme

Business/trading

activities

- Business/trading

activities in the sales outlet can be allowed in NER, LWE affected

districts, and A&N Islands.

- Retail

outlet/business selling khadi products/Village Industry products which are

purchased from khadi and village Industries institution approved by KVIC

and manufactured by PMEGP/SFURTI units only can be permitted under this

scheme across the country. The maximum cost of this kind of business

/trading activitiy will be 10 lakh and it will be at par with the service

sector.

Transport activities

Under this category

purchase of Cab/Van/Motor/Boat/Shikara etc for the transportation of tourist or

the general public is allowed. A ceiling of 10% will be applicable in this

category except for NER, Hilly region, LWE affected districts and A&N

island and Goa, Puducherry, Daman and Diu, Dadra Nagar haveli,J&K,

Lakshadeep

Eligibility criteria for the up- gradation of existing MUDRA/PMEGP units

- Margin

money claimed under PMEGP should have been already adjusted.

- The

first loan under this PMEGP/MUDRA should have been repaid in time.

- Said

unit should be in the profit with good turnover and it should have a

potential to further upgrade in turnover and profit.

What is the village industry?

Any village industry

(excluding those which are on the negative list) which is located in the rural

area which produces goods or provides services will be called village industry.

It should have fixed the capital investment for the head of full time of

artisan or workers don’t exceed one lakh in case of the plain area and 1.5 lakh

in case of hill area and in the case of A&N island and Laxdeep 4.5 lakh.

What

is Rural Area?

The area will be

called rural if it is in the revenue record of the state irrespective of the

population and also the town which has a population less than 20000.

Is EDP training is must for claiming the Margin Money Subsidy?

Yes EDP Training is

for 10 days for the project costing more than 5 lakh and for 6 working days

training for the project costing up to 5 lakh is a must for the beneficiaries

who would like to claim margin money subsidy.

How can apply for EDP Training?

Follow the following

step for EDP Training

- Get

the application ID

- Registered

mobile number

- Visit the website Click on “ EDP for

PMEGP beneficiary

- Choose

the course

- Click

on Register

- Fill

in the required detail.

- Once

registered, login and fill required detail.

Can the unit be set up in an urban area?

Yes, it can be set

up in the urban area but through the district Industries Center (DIC) only.

What is the lock-in period of Government Subsidy?

The Lock-in period

of Government subsidy is of 3 years.

Can the project be financed by two funding sources at the same time?

No. Under this

scheme no sub funding is available.

The Identification of the beneficiaries

Beneficiaries will

be identified at the district level. This will be done by the state/District

level agencies KVIC/State KVIB and state DICs and banks etc. Banks should be

involved from the beginning itself so that unnecessary bunching of the

applicants should be avoided. Applicants who have already done the training of

two weeks under entrepreneurship development program (EDP)/Skill development

program (SDP)/ Entrepreneurship cum Skill development program(ESDP)/Vocational

training (VT) no need to go for training again and also they should be given

the priority in selection.

Bank Finance

- Bank

will sanction 95% of the project cost in the case of special

category/Institution and 90% in the case of general category/Institution.

Bank will disburse the full amount appropriately for setting up a project.

- Beneficiaries

will be given capital expenditure as term loans and working capital as

cash credit. Bank can also give the amount in the project as a composite

loan consisting of capital expenditure and working capital

- The

Maximum project cost under PMEGP is 25 lakh including a term loan for

capital expenditure and working capital. Share of working capital should

not be more than 40% of the project cost in the case of manufacturing

units and should not be more than 60% of the project cost in the case of

the service/trading sector. In the case of manufacturing units, the

project cost may include a maximum capital expenditure of up to 25 lakh.

in that scenario, working capital over 25 lakh will not be covered under

the subsidy.

Rate of Interest and repayment schedule

- The

Prevailing market rate will be charged.

- The

Repayment payment schedule will be for 3-7 years

- The

Initial moratorium may be prescribed by the concern financial institution.

Modalities of the online process flow of application:

- The

Project proposal will be invited from potential beneficiaries at the

district level through print media, radio, and other media at periodical

intervals.

- Panchayati

raj institutions will also publish the scheme and help in the identification

of the beneficiaries.

- The

application will be filled in online mode only. This facility is available

for individual as well as institutional applicants.

Task Force

A task force with

the following members will be constituted at the district level for monitoring

the progress of the PMEGP scheme.

|

District Magistrate/Depty Commissioner/Collector

|

Chairman

|

|

PD-DRDA/EO-Zila Panchayet

|

Vice Chairman

|

|

Lead Bank Manger

|

Member

|

|

Repersentative of KVIC/KVIB/DIC

|

Member

|

|

Representative of NYKS/SC/ST Corporation

|

Special Invitee

|

|

Representative of MSME-DI,ITI/Polytechnic

|

Special Invitee

|

|

Representative from Panchayat( it has to be nominated by Chairman/District

Magistrate/Deputy Commissioner/Collector by rotation

|

3 members

|

|

Director RSETI/RUDSETI

|

Member

|

|

General Manager, DIC of the district

|

Member convener

|

Scorecard for disbursement of the loan

Personal Details of

the applicant need to be provided. In the case of the institution personal

details of the main promoter should be provided.

|

Sr No

|

Parameters

|

Maximum Marks

|

Marks scored

|

Criteria

|

Marks

|

|

1

|

Age

|

6

|

|

25 to 40

|

6

|

|

18 to 24

|

5

|

|

41 to 49

|

3

|

|

50 & above

|

2

|

|

2

|

No of Dependents

|

2

|

|

Upto 3

|

2

|

|

>3

|

0

|

|

3

|

Owing a house/Parental House

|

5

|

|

yes

|

5

|

|

No

|

2

|

|

4

|

Residing at the same location

|

5

|

|

5 years and above

|

5

|

|

2-5 years

|

3

|

|

Less than 2 years

|

2

|

|

5

|

Academic Qualification

|

4

|

|

Graduation

|

4

|

|

Intermediate or more

|

3

|

|

Metric

|

2

|

|

Below Metric

|

1

|

|

6

|

Experience in the line of trade

|

8

|

|

=>3 years

|

8

|

|

1 to 3 years

|

6

|

|

<1 year

|

3

|

|

Nill

|

0

|

|

7

|

Any other source of Income

incl.family

|

5

|

|

yes

|

5

|

|

No

|

0

|

|

8

|

Assessed for Income tax

|

2

|

|

Assessed

|

2

|

|

Not assesed

|

1

|

|

9

|

Have life Insurance

Policy(PMSBY,PMJJBY,APY or any other insurance policy)*Point 1 for each max 3

|

3

|

|

yes

|

*

|

|

No

|

0

|

|

10

|

Marks Scored

|

40

|

|

|

|

Scorecard

for New Venture /Firm for disbursement of the loan

|

Sr No

|

Parameters

|

Maximum Marks

|

Marks scored

|

Criteria

|

Marks

|

|

1

|

Relationship with lending bank

|

5

|

|

Above 3 years

|

5

|

|

1 to 3 years

|

3

|

|

< a year

|

2

|

|

New

|

1

|

|

2

|

Credit History

|

5

|

|

Very Good

|

5

|

|

Satisfactory

|

4

|

|

No history

|

3

|

|

3

|

Location advantage(Availability of

infrastructure ,raw materials,labour proximity to market etc

|

5

|

|

yes

|

5

|

|

No

|

3

|

|

4

|

Skill certification

course/RSETI/ITS/Computer knowledge

|

5

|

|

yes

|

5

|

|

No

|

2

|

|

5

|

Market tie ups for the sale of

products

|

5

|

|

yes

|

5

|

|

No

|

2

|

|

6

|

Line of activity

|

5

|

|

Mfg/Service

|

5

|

|

trade and others

|

3

|

|

7

|

Registered with government

authorities viz for sales tax/vat/license from local bodies/shop act etc

|

5

|

|

yes

|

5

|

|

No **

|

3

|

|

8

|

Re payment period (Not applicable

for only working capital loans)

|

5

|

|

Upto 5 years

|

5

|

|

Above 5 years

|

3

|

|

9

|

Employment Generation

|

5

|

|

Above 5

|

5

|

|

3 to 5

|

3

|

|

Self Employed

|

2

|

|

10

|

Avg DSCR (Not applicable for only

working capital loans)

|

5

|

|

> 2 Years

|

5

|

|

1.5. to 2

|

3

|

|

|

<1.5

|

2

|

|

|

Marks scored

|

50

|

|

|

|

|

|

**

|

It should be completed.

|

|

|

|

How can apply for the loan

- Visit

the official website of KVIC

- Then

click on PMEGP.

- New page will open up

- Click

PMEGP Portal

- Click

on online application form for the individual/ Nonindividual

- A new

page will open up. Fill in all the required detail.

- You

will get a user ID and password

- At

the time of final submission of the form, you will be provided the

application ID

- Applicant

Aadhar number will be preferred. If the applicant is an Institution then

the authorized person will furnish his/her Aadhar detail.

- After

filling the application and uploading all the required documents click the

summit. Once you submit then your application along with all the documents

will be forwarded to the district representative of KVIC, District

representative of state KVIB and District Industries center of the

concerned district

- After

receiving the documents within 5 working days Nodal officer of KVIC, State

KVIB, and DIC will speak to you personally through phone or personal

meeting. They will confirm that you have submitted the application for

scrutiny. With your consent/consultation, the nodal officers do all the

necessary corrections in your application. The nodal officer will provide

the hand-holding at every stage of the funding.

- The

implementing agencies after primary scrutiny of the application will

forward the complete/corrected application to the financing bank which has

been chosen by you. Copy of your complete application will also go to the

lead bank manager for information and monitoring.

·

The application will be forwarded to the bank within

3 weeks of forwarding by the

Implementing

agency

If you are interested in getting more information on this

then you may join our WhatsApp group

https://chat.whatsapp.com/LMIt9v8J9pILlusAOhb8cG